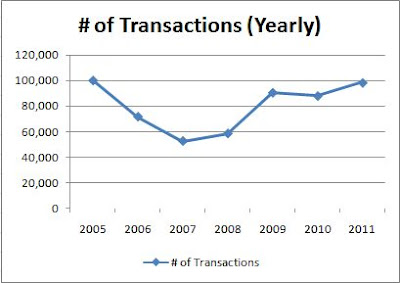

This data includes single family detached homes, patio homes, condos, and townhomes provided by the Arizona Multiple Listing Service. The monthly charts above are based on trailing twelve monthly averages from January 2011 to December 2011 which shows the total activity in the Phoenix Metropolitan real estate market over a twelve month period. The yearly charts above are based on a yearly average for 2005 to 2011.

As you can see from the first chart above, Position Realty Market Index, the first time home buyer tax credit created a great deal of demand in the market similar to the real estate boom from 2004 to 2006. When the government withdrew the first time home buyer tax credit on April 30, 2010, the average sold price and number of transactions decreased and the average days on market increased. Currently, the residential real estate market is experiences another buying frenzy that is caused without government intervention or relaxed mortgage underwriting standards. Consumers are jumping into the real estate market because market statistics are indicating the market has hit bottom and investors can purchase homes at rock bottom prices where they can rent the homes out to receive a 10% to 15% or more return on investment. In addition, the number of people losing their homes to foreclosure has caused an increase in the demand for rental properties, as can be seen in Chart #2.

Due to the current oversupply of homes on the market, real estate prices have not increased significantly but as you can see from Chart #3 real estate prices have started to increase since October 2011. Once the supply of homes is purchased, real estate prices will start to increase at a faster pace and then it will be too late to buy. Since January 2011, the average sold price has increased approximately +3.7% (up from last month), the average days on market have decreased approximately -17.1% (down from last month) and the number of transaction has increased approximately +18.4% (up from last month). It should be noted that approximately +35% of all transaction are cash purchases either by investors or homeowners due to tighter lending requirements. The volume of REO purchases since January is down -22.9% and the volume of short sale is up +64.9%. The volume of REO purchases are shrinking due to the increased volume of trustee sales and existing supply of inventory is getting absorbed at a faster rate.

The real estate market has reached a level of equilibrium where demand is equal to supply and all buyers are rushing into the market to take advantage of low prices. Once the supply of residential homes is exhausted and demand continues to increase, real estate prices will begin to rise (depends on the sustained level of demand). Trying to “time the market” for the perfect time to buy is nearly impossible but there is no better time than now to purchase. Real estate prices are at an all time low, mortgage rates are at a historical low and the market appears to be improving both in terms of prices and the overall economy. Time to buy is NOW!! Give us a call to discuss your best buying strategy, TODAY!!