3312 N 40th AVE: Visual shows :: MUST SEE!! Remodeled living room/dining and kitchen - Open floor plan

with laminate floors, newer berber carpet in hallway and bedrooms,

huge kitchen with peninsula, separate range/wall oven, walk-in pantry,

upgraded/remodeled bathroom with tub/shower combo, tile floors and

beautiful vanity. Updated/remodeled master 3/4 bathroom, tiled

standing shower and pedestal sink. Dual pane windows, sparkling pool

with new pump (2011) perfect for the HOT summer days! North / South

exposure! Dont miss this great opportunity!!

On this Blog, we will supply our subscribers with important information about Phoenix Real Estate market trends and a variety of information about advanced real estate topics. This information will be on mortgage interest rates, government changes effecting real estate, creative financing alternatives, creative ways to sell you property, how to flip real estate and much more.

Saturday, May 26, 2012

Thursday, April 19, 2012

10 Inexpensive Ways To Spice Up Phoenix Rental or Home

It's easy to fix up your properties if you have unlimited cash. However, you need to keep your repairs to a minimum especially if the home is a rental property or you are planning to sell the home. There are the basic improvements, such as carpet and paint, but these can still costs thousands of dollars. The following are some inexpensive ways to improve your properties with very little cash.

#1) New Electrical Switch Plates

This is such a minor, yet overlooked improvement. Most rental owners and rehabbers paint a unit and leave the old, ugly switch plates. Even worse, some even paint over them.

New switch plates cost about 50 cents each. You can replace the entire house with new switch plates for about $20. For the foyer, living room and other obvious areas, spring for nice brass plates. They run about $5 each - not much for added class.

#2) New or Improved Doors

Another overlooked, yet cheap replacement item is doors. If you have ugly brown doors, replace them with nice white doors (you can paint them, but unless you have a spray gun it will take you three coats by hand).

The basic hollow-core door is about $20. It comes pre-primed and pre-hung. For about $10 more, you can buy stylish six-panel doors. If you are doing a rehab, the extra $10 per door is well worth-it. For rentals, consider at least changing the downstairs doors.

#3) New Door Handles

In addition to changing doors, consider changing the handles. An old door handle (especially with crusted paint on it) looks drab. For about $10, you can replace them with new brass finished handles. Replace the guest bathroom and bedroom door handles with the fancy "S" handles (about $20 each).

#4) Paint/Replace Trim

If the entire interior of the house does not need a paint job, consider painting the trim. New, modern custom homes typically come with beige or off-white walls and bright-white trim. Use a semi-gloss bright white on all the trim in your houses.

If the floor trim is worn, cracked or just plain ugly, replace it! Home Depot carries a new foam trim that is pre-painted in several finishes and costs less than 50 cents per linear foot. Create a great first impression by adding crown molding in the entry way and living room.

#5) New Front Door

You only get one chance to make a first impression. A cheap front door makes a house look cheap. An old front door makes a house look old. If you have nice heavy door, paint it a bold color using a high-gloss paint. If your front door is old, consider replacing it with a new, stylish door. For about $125, you can buy a very nice door.

#6) Tile Foyer Entry

After the front door, your next first impression is the foyer area. Most rental property foyers are graced with linoleum floors. Consider a nice 12" Mexican tile. An 8' x 8' area should cost about $100 in materials.

#7) New Shower Curtains

It amazes me that many landlords and sellers show properties with either no shower curtain or any ugly old shower curtain in the bathroom. Don't be cheap - drop $40 and buy a nice new rod and fancy curtain.

#8) Paint Kitchen Cabinets

Replacing kitchen cabinets is expensive, but painting them is cheap. If you have old 1970's style wooden cabinets in a lovely dark brown shade, paint them. Use a semi-gloss white and finish them with colorful plastic knobs. No need to paint the inside of them (unless you own a spray gun), since you are only trying to make an impression.

Americans spend 99% of their time in the kitchen (when they are not watching TV). A fancy modern faucet looks great in the kitchen. They can run as much as $150, but not to worry - most retailers (Home Depot, Home Base, etc) often run clearance sales on overstocked and discontinued models. I have found nice Delta and Price Pfister faucets for about $60 on sale.

#9) Add Window Shutters

If you have ugly aluminum framed windows, consider adding wooden shutters outside. They come pre-primed at most hardware retailers and are easy to install. Paint them an offset color from the outside of the house - (e.g., if the house is dark, paint the shutters white. If the house is light, paint them green, blue, etc.).

#10) Add a Nice Mailbox

Everyone on the block has the same black mailbox. Stand out. Be bold. For about $35 you can buy a nice colorful mailbox. For about $60 more, you can buy a nice wooden post for it. People notice these things....and they like them!

#1) New Electrical Switch Plates

This is such a minor, yet overlooked improvement. Most rental owners and rehabbers paint a unit and leave the old, ugly switch plates. Even worse, some even paint over them.

New switch plates cost about 50 cents each. You can replace the entire house with new switch plates for about $20. For the foyer, living room and other obvious areas, spring for nice brass plates. They run about $5 each - not much for added class.

#2) New or Improved Doors

Another overlooked, yet cheap replacement item is doors. If you have ugly brown doors, replace them with nice white doors (you can paint them, but unless you have a spray gun it will take you three coats by hand).

The basic hollow-core door is about $20. It comes pre-primed and pre-hung. For about $10 more, you can buy stylish six-panel doors. If you are doing a rehab, the extra $10 per door is well worth-it. For rentals, consider at least changing the downstairs doors.

#3) New Door Handles

In addition to changing doors, consider changing the handles. An old door handle (especially with crusted paint on it) looks drab. For about $10, you can replace them with new brass finished handles. Replace the guest bathroom and bedroom door handles with the fancy "S" handles (about $20 each).

#4) Paint/Replace Trim

If the entire interior of the house does not need a paint job, consider painting the trim. New, modern custom homes typically come with beige or off-white walls and bright-white trim. Use a semi-gloss bright white on all the trim in your houses.

If the floor trim is worn, cracked or just plain ugly, replace it! Home Depot carries a new foam trim that is pre-painted in several finishes and costs less than 50 cents per linear foot. Create a great first impression by adding crown molding in the entry way and living room.

#5) New Front Door

You only get one chance to make a first impression. A cheap front door makes a house look cheap. An old front door makes a house look old. If you have nice heavy door, paint it a bold color using a high-gloss paint. If your front door is old, consider replacing it with a new, stylish door. For about $125, you can buy a very nice door.

#6) Tile Foyer Entry

After the front door, your next first impression is the foyer area. Most rental property foyers are graced with linoleum floors. Consider a nice 12" Mexican tile. An 8' x 8' area should cost about $100 in materials.

#7) New Shower Curtains

It amazes me that many landlords and sellers show properties with either no shower curtain or any ugly old shower curtain in the bathroom. Don't be cheap - drop $40 and buy a nice new rod and fancy curtain.

#8) Paint Kitchen Cabinets

Replacing kitchen cabinets is expensive, but painting them is cheap. If you have old 1970's style wooden cabinets in a lovely dark brown shade, paint them. Use a semi-gloss white and finish them with colorful plastic knobs. No need to paint the inside of them (unless you own a spray gun), since you are only trying to make an impression.

Americans spend 99% of their time in the kitchen (when they are not watching TV). A fancy modern faucet looks great in the kitchen. They can run as much as $150, but not to worry - most retailers (Home Depot, Home Base, etc) often run clearance sales on overstocked and discontinued models. I have found nice Delta and Price Pfister faucets for about $60 on sale.

#9) Add Window Shutters

If you have ugly aluminum framed windows, consider adding wooden shutters outside. They come pre-primed at most hardware retailers and are easy to install. Paint them an offset color from the outside of the house - (e.g., if the house is dark, paint the shutters white. If the house is light, paint them green, blue, etc.).

#10) Add a Nice Mailbox

Everyone on the block has the same black mailbox. Stand out. Be bold. For about $35 you can buy a nice colorful mailbox. For about $60 more, you can buy a nice wooden post for it. People notice these things....and they like them!

Interested In Buying Commercial Real Estate?

When you are looking at a commercial real estate deal you will hear terms such as "Cash on Cash return", "Net Operating Income" or "NOI" and "CAP Rate".

If you are new to commercial real estate these terms may be foreign to you, so lets get you into the swing of things by teaching you one of the key real estate investing terms for commercial real estate.

CAP rate stands for "Capitalization Rate" and measures the return on an investment in a commercial building. The CAP rate can confuse a new investor because it ignores any debt on the property. That is helpful because it shows the return on the investment in an absolute sense and allows you to compare investment alternatives in different buildings without being confused by the financing on the property, which can muddy the analysis. CAP rate is NOT the same as cash flow, which would take into consideration mortgage payments.

CAP Rate is calculated by taking the income and deducting all expenses other than the mortgage, then dividing that into the purchase price. For example:

If you had rental income of $120,000 per year, expenses (other than mortgage interest) of $30,000 per year you would have $90,000 per year leftover. The expenses that you include are regular expenses like electric, gas and oil paid by the landlord as well as irregular expenses like periodic repairs and maintenance.

In the example above, if you paid one million dollars for the building and had annual cash flow after expenses other than mortgage interest of $90,000 then you would have a cash return of $90,000 on a million dollar investment - which would represent a nine percent return. ($90,000/$1,000,000 = 9%).

CAP rate is a good way to compare investment alternatives. The higher the CAP rate the better because a higher CAP rate refers to a higher return for you.

Retail priced properties have CAP rates that vary by area and type of property. CAP rates can be as low as 5% - for example a unit of Goldman Sachs is asking $42 million for the 250 Unit Palladium in Scottsdale Arizona - a beautiful class "A" apartment building in a hot rental market or CAP rates can exceed 10% for class "B" and "C" apartment buildings in less desirable cities and in older buildings.

In other classes of buildings that are also class "A" CAP rates can be higher. For example a Wells real estate partnership (REIT out of Georgia) is the 275,000 square foot Highland Landmark 3 in Downers Grove Illinois at a 7% CAP rate. That building is 97% occupied and is also a class "A" building having been built in 2000 and featuring modern system, aesthetics and functionality.

CAP rates are market and building type specific so you will need to learn your market by looking at asking prices, comparable selling prices and speaking with market participants (investors, bankers, brokers) to see what your market is like.

For most small investors your best purchases will be class “B” apartment buildings where CAP rates are at least 10%. You will note that a 10% return is MUCH higher than any bank will give you and probably the highest return on a safe investment that you can find today. That is, in a nutshell, why cash flow investing in apartment buildings and other commercial properties is so attractive.

Give us a call TODAY to discuss your commercial real estate needs 480-213-5251

If you are new to commercial real estate these terms may be foreign to you, so lets get you into the swing of things by teaching you one of the key real estate investing terms for commercial real estate.

CAP rate stands for "Capitalization Rate" and measures the return on an investment in a commercial building. The CAP rate can confuse a new investor because it ignores any debt on the property. That is helpful because it shows the return on the investment in an absolute sense and allows you to compare investment alternatives in different buildings without being confused by the financing on the property, which can muddy the analysis. CAP rate is NOT the same as cash flow, which would take into consideration mortgage payments.

CAP Rate is calculated by taking the income and deducting all expenses other than the mortgage, then dividing that into the purchase price. For example:

If you had rental income of $120,000 per year, expenses (other than mortgage interest) of $30,000 per year you would have $90,000 per year leftover. The expenses that you include are regular expenses like electric, gas and oil paid by the landlord as well as irregular expenses like periodic repairs and maintenance.

In the example above, if you paid one million dollars for the building and had annual cash flow after expenses other than mortgage interest of $90,000 then you would have a cash return of $90,000 on a million dollar investment - which would represent a nine percent return. ($90,000/$1,000,000 = 9%).

CAP rate is a good way to compare investment alternatives. The higher the CAP rate the better because a higher CAP rate refers to a higher return for you.

Retail priced properties have CAP rates that vary by area and type of property. CAP rates can be as low as 5% - for example a unit of Goldman Sachs is asking $42 million for the 250 Unit Palladium in Scottsdale Arizona - a beautiful class "A" apartment building in a hot rental market or CAP rates can exceed 10% for class "B" and "C" apartment buildings in less desirable cities and in older buildings.

In other classes of buildings that are also class "A" CAP rates can be higher. For example a Wells real estate partnership (REIT out of Georgia) is the 275,000 square foot Highland Landmark 3 in Downers Grove Illinois at a 7% CAP rate. That building is 97% occupied and is also a class "A" building having been built in 2000 and featuring modern system, aesthetics and functionality.

CAP rates are market and building type specific so you will need to learn your market by looking at asking prices, comparable selling prices and speaking with market participants (investors, bankers, brokers) to see what your market is like.

For most small investors your best purchases will be class “B” apartment buildings where CAP rates are at least 10%. You will note that a 10% return is MUCH higher than any bank will give you and probably the highest return on a safe investment that you can find today. That is, in a nutshell, why cash flow investing in apartment buildings and other commercial properties is so attractive.

Give us a call TODAY to discuss your commercial real estate needs 480-213-5251

Which Is Better? To Fix and Flip or Buy and Hold?

A lot of investors contact me wanting to get into real estate investing and they always want to start with fix and flip because they watched a show on HGTV or DIY about fixing and flipping. In all actually, doing a fix and flips is very time consuming and if you have a full time job, then this might not be the best way to get into real estate investing.

So, is fixing and flipping more profitable than a buy and hold strategy? The average fix and flip investor earns approximately a 10% to 12% annualized "return on investment". This is because when the market is over saturated with investors it become more and more difficult to find a property that will be profitable. There are a lot of properties on the market but not all of them are perfect candidates for a fix and flip opportunity. Therefore, when a good fix and flip opportunity comes on the market you are often times forced to pay a higher price and accept a lower return on investment. Remember, your profits are made in a fix and flip when you purchase and not when you sell.

If you are not willing to accept a lower return on investment, then you will be waiting months before you can employ your investments dollars and start earning a profit. The longer you wait to employ your investment dollars the lower your annualized return on investment. Also, if you are not a contractor or can't determine the exact cost of the rehab work, then your fix and flip project might become less profitable due to higher expenses. Furthermore, if you don't have your own cash and you have to use a "hard money" lender, then you will have interest costs that will lower your return on investment.

Due to increased competition, it could take you three months or more to purchase your first fix and flip deal, it could take you another month to complete the rehab work and another month or two to resell the property. By the time you make a profit, it could be six months or more!

If you purchase a rental property in an appreciating market (the market Phoenix is experiencing), then overall you will earn more money on an annualized basis than the average fix and flip investor. How is this possible? Well, if you purchase a single family home at $90,000 cash and rents in the area are $1,200 per month, then before taxes, insurance and HOA you are earning a 16% return on investment. This does not include the appreciation rate of the home.

For your net return on investment, lets say, taxes are $1,100 per year, insurance is $350 per year and HOA is $50 per month. This would be a 14% net return on investment ($1,200 - $92 taxes - $30 insurance - $50 HOA = $1,028 X 12 = $12,336 / $90,000). If the home is appreciating at a rate of 3% per year, then this is a 17% return on investment per year. Even better if the appreciation rate is higher!!

A buyer and hold investment strategy is much better than a fix and flip because the investment is a "passive investment" (if you hire a property manager) and your return on investment is higher. Also, you can take advantage of a 1031 Exchange or purchase the rental property with a Self Directed IRA to defer the capital gains.

Give us a call TODAY if you are interested in putting your investment dollars to work! 480-213-5251

So, is fixing and flipping more profitable than a buy and hold strategy? The average fix and flip investor earns approximately a 10% to 12% annualized "return on investment". This is because when the market is over saturated with investors it become more and more difficult to find a property that will be profitable. There are a lot of properties on the market but not all of them are perfect candidates for a fix and flip opportunity. Therefore, when a good fix and flip opportunity comes on the market you are often times forced to pay a higher price and accept a lower return on investment. Remember, your profits are made in a fix and flip when you purchase and not when you sell.

If you are not willing to accept a lower return on investment, then you will be waiting months before you can employ your investments dollars and start earning a profit. The longer you wait to employ your investment dollars the lower your annualized return on investment. Also, if you are not a contractor or can't determine the exact cost of the rehab work, then your fix and flip project might become less profitable due to higher expenses. Furthermore, if you don't have your own cash and you have to use a "hard money" lender, then you will have interest costs that will lower your return on investment.

Due to increased competition, it could take you three months or more to purchase your first fix and flip deal, it could take you another month to complete the rehab work and another month or two to resell the property. By the time you make a profit, it could be six months or more!

If you purchase a rental property in an appreciating market (the market Phoenix is experiencing), then overall you will earn more money on an annualized basis than the average fix and flip investor. How is this possible? Well, if you purchase a single family home at $90,000 cash and rents in the area are $1,200 per month, then before taxes, insurance and HOA you are earning a 16% return on investment. This does not include the appreciation rate of the home.

For your net return on investment, lets say, taxes are $1,100 per year, insurance is $350 per year and HOA is $50 per month. This would be a 14% net return on investment ($1,200 - $92 taxes - $30 insurance - $50 HOA = $1,028 X 12 = $12,336 / $90,000). If the home is appreciating at a rate of 3% per year, then this is a 17% return on investment per year. Even better if the appreciation rate is higher!!

A buyer and hold investment strategy is much better than a fix and flip because the investment is a "passive investment" (if you hire a property manager) and your return on investment is higher. Also, you can take advantage of a 1031 Exchange or purchase the rental property with a Self Directed IRA to defer the capital gains.

Give us a call TODAY if you are interested in putting your investment dollars to work! 480-213-5251

Friday, April 13, 2012

More Buyers See Opportunity in Vacation Homes

Some buyers are calling the vacation-home market the “perfect storm,” — falling home values, low mortgage rates, and increased affordability — which is prompting more opportunity in the second-home market.

The National Association of REALTORS® reported last week that vacation home sales increased 7 percent in 2011 over the prior year. Of those surveyed, 33 percent of the vacation home owners surveyed say they purchased a home because of the low real estate prices. Also, 91 percent reported they plan to rent out their second home purchase in the next year. Seventy-one percent say the higher rental income potential from investment properties helped motivate their purchase.

Many second home owners may have been sitting on the sideline, waiting for the perfect time to pounce on bargain prices, but are seeing that time as now, housing experts say. And more buyers are making all-cash purchases, too: 42 percent of vacacation-home buyers paid cash for their home, according to the NAR survey.

Vacation home buyers are also looking past popular beach or ski resorts to make their purchase, says Walter Molony, spokesman for the National Association of REALTORS®. "Many are in lesser-well-known areas, places known mainly on a regional basis,” says Molony, adding that places such as Gatlinburg, Tenn.; Brown County, Ind.; and Williamsburg, Ky. are seeing more attention from buyers in vacation-home purchases.

“Name destination resorts are only a component of the picture,” Molony told MSNBC.com. “Most people want to be within an easy drive of their vacation home.”

Most buyers that purchase Phoenix vacation homes plan to use the home for one or two months out of the year and then rent the units out for the remaining months. Short term vacation rentals are able to receive a higher rental rate than long term rentals; therefore, making them very attractive to vacation home buyers. Vacation rentals in Scottsdale receive a higher premium than other parts of the Phoenix Metropolitan Area.

The National Association of REALTORS® reported last week that vacation home sales increased 7 percent in 2011 over the prior year. Of those surveyed, 33 percent of the vacation home owners surveyed say they purchased a home because of the low real estate prices. Also, 91 percent reported they plan to rent out their second home purchase in the next year. Seventy-one percent say the higher rental income potential from investment properties helped motivate their purchase.

Many second home owners may have been sitting on the sideline, waiting for the perfect time to pounce on bargain prices, but are seeing that time as now, housing experts say. And more buyers are making all-cash purchases, too: 42 percent of vacacation-home buyers paid cash for their home, according to the NAR survey.

Vacation home buyers are also looking past popular beach or ski resorts to make their purchase, says Walter Molony, spokesman for the National Association of REALTORS®. "Many are in lesser-well-known areas, places known mainly on a regional basis,” says Molony, adding that places such as Gatlinburg, Tenn.; Brown County, Ind.; and Williamsburg, Ky. are seeing more attention from buyers in vacation-home purchases.

“Name destination resorts are only a component of the picture,” Molony told MSNBC.com. “Most people want to be within an easy drive of their vacation home.”

Most buyers that purchase Phoenix vacation homes plan to use the home for one or two months out of the year and then rent the units out for the remaining months. Short term vacation rentals are able to receive a higher rental rate than long term rentals; therefore, making them very attractive to vacation home buyers. Vacation rentals in Scottsdale receive a higher premium than other parts of the Phoenix Metropolitan Area.

How Long To Repurchase ~ Foreclosure / Bankruptcy / Short Sale

HOW LONG FOR - FORECLOSURE AND/OR DEED IN LIEU OF FORECLOSURE

HOW LONG FOR - BANKRUPTCIES – CHAPTER 7 AND CHAPTER 13

SHORT SALES

Short sales are typically treated the same as foreclosures as listed above. However, the exception for FHA would be if all debts including the mortgages were paid as agreed for a 12 month period leading up to the short sale. The exception for conventional is that Fannie Mae will allow for a purchase 2 years post short sale if it reported on the borrowers credit report as a 5 or below (short sale status).

- FHA - 3 years from the completion date of the foreclosure

- CONFORMING - 7 years from the completion date of the foreclosure

- VA - 2 years from the completion date of the foreclosure

- USDA RURAL - 3 years from the completion date of the foreclosure

HOW LONG FOR - BANKRUPTCIES – CHAPTER 7 AND CHAPTER 13

- FHA - Chapter 7 requires 2 years from discharge date. Chapter 13 requires 1 year with satisfactory pay history and court approval.

- CONFORMING - Chapter 7 requires 4 years from discharge date. Chapter 13 requires 2 years from discharge date.

- VA - Chapter 7 requires 2 years from discharge date. Chapter 13 requires 1 year with satisfactory pay history and court approval.

- USDA RURAL - Chapters 7 and 13 require 3 years from discharge date.

SHORT SALES

Short sales are typically treated the same as foreclosures as listed above. However, the exception for FHA would be if all debts including the mortgages were paid as agreed for a 12 month period leading up to the short sale. The exception for conventional is that Fannie Mae will allow for a purchase 2 years post short sale if it reported on the borrowers credit report as a 5 or below (short sale status).

New Opportunities with Real Estate IRAs

With the continuing changes in tax legislation, came a benefit for IRA contributions: The non-working spousal limit of $250 was raised to $2,000. Although an additional annual contribution of $2,000 doesn't appear to be much, it works out to a very large amount over time considering that note returns are between 8% and 12%.

Over 20 years, a total of $40,000 contributed ($2,000 annually) works out to be about $100,000 at 8%. Of course, as IRA money, this is all tax deferred. For a married couple the additional $2,000 makes it to $200,000. Real property transactions can improve yields significantly. Property flips have been on the scene again, and some people have used their tax deferred IRAs and Qualified Plans to manage a greater than 30% return.

Real Estate and Your Retirement Plan

This return rate means that the account holder has put a lot of work into making this work. The most common method has been rehabs, using the funds in the account for the down, financing the rest for a short time period inside the plan, and then flipping the property. The hardest part is finding a lender who can understand this transaction in the first place.

Back in the "old days" of the 1980s there were many institutional lenders who understood that these were equity only loans. The lenders always had the IRA or Qualified Plan owner guarantee the loans personally. (No, the trustee of the IRA wouldn't ever do that: there are rules about that.) In the 1990s we are seeing more hard money and private lenders step in, and lots of carry back.

So real estate investing is still a great way to make investments in your retirement plan. In fact, we are seeing more and more probably as a result of the very heated stock market. The stock market has done tremendously well, but to some it appears that a bear market may be around the corner. After all, the feverish pace can't continue forever.

As people are making an effort to diversify, they are gravitating to real estate property and mortgages again. Some qualified plans, such as 401(k) and Profit Sharing/Money Purchase plans have been selecting fund families which are real estate oriented. Although there are not many in this group, it is a change from the last few years where most companies have chosen a diverse set of funds, not including real estate.

It's Simple to Use Your Retirement Fund for Real Estate

So how do you do this? It's simple. First, you have to have an IRA, SEP-IRA or Qualified Plan, such as a Keogh, or be the decision maker in a multiple employee plan such as a 401(k) that has at least $20,000. Less than that makes you unhappy because of the fees that get charged relative to the return you get. Fees for administration are usually based on the asset value in your account, and run typically $600 per $100,000 per year. It's really a bargain when you consider the work involved.

Second, you need to have the account or plan with a custodian who allows for complete self direction. Just ask your custodian or trustee to buy a real estate note or property in your account or plan, and see the response. If you hear a "yes" answer, ask who prepares all the paperwork and who services the property. If you don't get a blank look or a "we don't do that," you may have found the place you are looking for.

Third, now that you have found the right custodian/administrator, you get to do all of the hard work. A self directed plan is just that. You are the SELF in self directed. You get to find the property, or the assets that you want to buy with your plan funds. The custodian/administrator provides the plan capability and expertise to see you through the transaction and does all the record keeping, compliance and administration for your account and assets.

So this is how it works. It seems straightforward and it is. You have to follow the rules the government lays out. The big ones are that you have to qualify to have an account, you can only make cash contributions, you can't deal with yourself and your plan, or relatives (siblings are permitted). And here's the payoff for following the rules: The return on your assets is tax deferred, which means tax free until you start withdrawing them without penalty, usually after age 59. Yes, people can make a huge amount in their retirement plan with real estate they find. And yes, it is perfectly legal.

Over 20 years, a total of $40,000 contributed ($2,000 annually) works out to be about $100,000 at 8%. Of course, as IRA money, this is all tax deferred. For a married couple the additional $2,000 makes it to $200,000. Real property transactions can improve yields significantly. Property flips have been on the scene again, and some people have used their tax deferred IRAs and Qualified Plans to manage a greater than 30% return.

Real Estate and Your Retirement Plan

This return rate means that the account holder has put a lot of work into making this work. The most common method has been rehabs, using the funds in the account for the down, financing the rest for a short time period inside the plan, and then flipping the property. The hardest part is finding a lender who can understand this transaction in the first place.

Back in the "old days" of the 1980s there were many institutional lenders who understood that these were equity only loans. The lenders always had the IRA or Qualified Plan owner guarantee the loans personally. (No, the trustee of the IRA wouldn't ever do that: there are rules about that.) In the 1990s we are seeing more hard money and private lenders step in, and lots of carry back.

So real estate investing is still a great way to make investments in your retirement plan. In fact, we are seeing more and more probably as a result of the very heated stock market. The stock market has done tremendously well, but to some it appears that a bear market may be around the corner. After all, the feverish pace can't continue forever.

As people are making an effort to diversify, they are gravitating to real estate property and mortgages again. Some qualified plans, such as 401(k) and Profit Sharing/Money Purchase plans have been selecting fund families which are real estate oriented. Although there are not many in this group, it is a change from the last few years where most companies have chosen a diverse set of funds, not including real estate.

It's Simple to Use Your Retirement Fund for Real Estate

So how do you do this? It's simple. First, you have to have an IRA, SEP-IRA or Qualified Plan, such as a Keogh, or be the decision maker in a multiple employee plan such as a 401(k) that has at least $20,000. Less than that makes you unhappy because of the fees that get charged relative to the return you get. Fees for administration are usually based on the asset value in your account, and run typically $600 per $100,000 per year. It's really a bargain when you consider the work involved.

Second, you need to have the account or plan with a custodian who allows for complete self direction. Just ask your custodian or trustee to buy a real estate note or property in your account or plan, and see the response. If you hear a "yes" answer, ask who prepares all the paperwork and who services the property. If you don't get a blank look or a "we don't do that," you may have found the place you are looking for.

Third, now that you have found the right custodian/administrator, you get to do all of the hard work. A self directed plan is just that. You are the SELF in self directed. You get to find the property, or the assets that you want to buy with your plan funds. The custodian/administrator provides the plan capability and expertise to see you through the transaction and does all the record keeping, compliance and administration for your account and assets.

So this is how it works. It seems straightforward and it is. You have to follow the rules the government lays out. The big ones are that you have to qualify to have an account, you can only make cash contributions, you can't deal with yourself and your plan, or relatives (siblings are permitted). And here's the payoff for following the rules: The return on your assets is tax deferred, which means tax free until you start withdrawing them without penalty, usually after age 59. Yes, people can make a huge amount in their retirement plan with real estate they find. And yes, it is perfectly legal.

Wednesday, April 4, 2012

Phoenix Real Estate Market Report Summary ~ March 2012

Phoenix Real Estate Market Report Summary

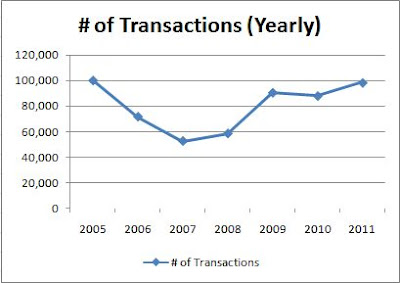

This data includes single family detached homes, patio homes, condos, and townhomes provided by the Arizona Multiple Listing Service. The monthly charts above are based on trailing twelve monthly averages from April 2011 to March 2012 which shows the total activity in the Phoenix Metropolitan real estate market over a twelve month period. The yearly charts above are based on a yearly average for 2005 to 2011 but a trailing twelve month average from April 2011 to March 2012 for the year 2012. Without the trailing twelve month average for the year 2012, the charts would be substantially skewed and would not portray an accurate view of the market on an annual basis.

As you can see from the first chart above, Position Realty Market Index, the first time home buyer tax credit created a great deal of demand in the market similar to the real estate boom from 2004 to 2006. When the government withdrew the first time home buyer tax credit on April 30, 2010, the average sold price and number of transactions decreased and the average days on market increased. Currently, the residential real estate market is experiences another buying frenzy that is caused without government intervention or relaxed mortgage underwriting standards. Consumers are jumping into the real estate market because market statistics are indicating the market has hit bottom and investors can purchase homes at rock bottom prices where they can rent the homes out to receive a 10% to 15% or more return on investment. As found in the Average Sold Price chart above, real estate prices have been increasing steadily since October 2011 due the increase in demand. The current supply of homes for sale on the market is 20,542 where a year ago there were 48,000 homes for sale.

Since October 2011 (6 months ago), the average sold price has increased approximately +18.6% (up from last month), the average days on market have decreased approximately -2.2% (down from last month) and the number of transaction has increased approximately 15.6% (up from last month). The largest price increase over the last 12 months was experienced last month with a price increase of +8.9%. It should be noted that approximately +35% of all transaction are cash purchases either by investors or homeowners due to tighter lending requirements. The volume of REO purchases since October is down -40.2% and the volume of short sale is up +2.6%. The volume of REO purchases are shrinking due to the increased volume of trustee sales, more banks are accepting short sale transaction and existing supply of inventory is getting absorbed at a faster rate.

The real estate market has reached a level of equilibrium where demand exceeds supply and all buyers are rushing into the market to take advantage of low prices. As more and more buyers enter the market and as more of the supply of residential homes are exhausted, real estate prices will increase at a faster rate (depends on the sustained level of demand). Trying to “time the market” for the perfect time to buy is nearly impossible but there is no better time than now to purchase. Real estate prices are at an all time low (not for long), mortgage rates are at a historical low and the market is improving both in terms of prices and the overall economy. Time to buy is NOW!! Give us a call to discuss your best buying strategy, TODAY!!

New Changes To FHA Lending Guidelines ~ Will You Be Impacted?

This is very important news about the recent changes to FHA loans, the new FHA guidelines. Especially since 95% of new financing is being originated as FHA loans. The changes in mortgage insurance really wont impact borrowers as much. For example, on a $150,000 purchase, the monthly insurance payment will increase by $18.00 a month.

However, the following notice to the FHA loan requirements is going to knock out a lot people from the market. This is FHA's solution to motivate borrowers to clean up their credit and negotiate payment plans.

Collection Accounts and Judgments:

Open collection accounts and judgments must be addressed in following ways:

If the total outstanding balance of all collection accounts is equal to or greater than $1,000 the borrower must resolve the accounts (e.g. entered into payment arrangements with a minimum of three months verified payments made as agreed in payment plan) or paid in full prior to closing. Documentation must be provided to show that each account was resolved or paid in full. Any payments arranged for the collections must be included in the calculation of the borrower’s debt-to-income ratios.

If the total outstanding balance of all collection accounts is less than $1,000, the borrower is not required to pay off the collection accounts as a condition of mortgage approval.

Note: Paying “down” of balances on collections to reduce the singular or cumulative balance to below $1,000, is not an acceptable resolution of accounts.

However, the following notice to the FHA loan requirements is going to knock out a lot people from the market. This is FHA's solution to motivate borrowers to clean up their credit and negotiate payment plans.

Collection Accounts and Judgments:

Open collection accounts and judgments must be addressed in following ways:

If the total outstanding balance of all collection accounts is equal to or greater than $1,000 the borrower must resolve the accounts (e.g. entered into payment arrangements with a minimum of three months verified payments made as agreed in payment plan) or paid in full prior to closing. Documentation must be provided to show that each account was resolved or paid in full. Any payments arranged for the collections must be included in the calculation of the borrower’s debt-to-income ratios.

If the total outstanding balance of all collection accounts is less than $1,000, the borrower is not required to pay off the collection accounts as a condition of mortgage approval.

Note: Paying “down” of balances on collections to reduce the singular or cumulative balance to below $1,000, is not an acceptable resolution of accounts.

Do Kitchens Really Sell a House?

It's a tool used by house flippers all across the nation. Stagers know its power. Real estate agents push its importance. What is this not-so-well-kept secret of real estate? A kitchen can sell a house.

A kitchen is the heart of a home. This is true all across the globe. The old saying that the "stomach is the way to the heart" carries a lot of truth. Kitchens are where we spend much of our time and most of that is with our families. It's the room where we nourish our bodies and our spirits.

Kitchens are integral to entertaining and in today's age of open floor plans, they're a focal piece of many family rooms. It's because of this that kitchens play such an important role in the buying and selling process.

This one room is the showpiece of the house. You'll see it every day and your guests will see it during most visits. This means buyers want homes with up-to-date kitchens.

Kitchens, however, can be one of the most expensive rooms to renovate. These projects can also be the most labor and time intensive of all home renovations. It's not just a new layer of paint.

Instead you find a complicated array of flooring, tiling, cabinets, and counters. This means buyers may want a home with an up-to-date kitchen but they aren't willing to tackle this problem themselves. Most buyers want a kitchen that is ready to use the day they move in.

What do buyers look for in up-to-date kitchens? A lot of this depends on what price range your home is in.

The main thing to remember as a seller is to not price yourself out of your market. If homes in your neighborhood are selling for $100,000 with tidy, but not luxury kitchens, then this is no time to upgrade to granite, travertine, and marble at the price tag of $40,000+. You simply won't find a buyer.

Scope out the competition. Use open houses in your area or MLS listings to find out what your competitions' kitchens look like.

Do area homes have new solid wood cabinets and granite counters in today's designer colors? You'll be wise to consider making the same move. Are they including new stainless steel appliances and add-ons like dishwashers, wine-coolers, and trash compactors?

Are you in a higher-end neighborhood? It's time to think high-end. Your older home may have a highly functional kitchen, but a buyer will take one look at your formica counters and white appliances and become lost in the stress of how much money and time it would take to remodel. If you don't want to put in the time yourself to make upgrades then you'll have to make concessions in the price.

Don't become overwhelmed, though. Sometimes a kitchen update can mean doing just a few minor changes. Change the paint color to a warm, neutral tone. Get rid of any clutter. Update your appliances, paint your cabinets, change the pulls, or get a high-end looking counter for a fraction of the cost (faux-granite or lower end granite). You might even save a bundle by doing much of the work yourself.

The bottom line is a kitchen can sell a home. Do a little research and find out what your kitchen needs to make it competitive with area listings.

A kitchen is the heart of a home. This is true all across the globe. The old saying that the "stomach is the way to the heart" carries a lot of truth. Kitchens are where we spend much of our time and most of that is with our families. It's the room where we nourish our bodies and our spirits.

Kitchens are integral to entertaining and in today's age of open floor plans, they're a focal piece of many family rooms. It's because of this that kitchens play such an important role in the buying and selling process.

This one room is the showpiece of the house. You'll see it every day and your guests will see it during most visits. This means buyers want homes with up-to-date kitchens.

Kitchens, however, can be one of the most expensive rooms to renovate. These projects can also be the most labor and time intensive of all home renovations. It's not just a new layer of paint.

Instead you find a complicated array of flooring, tiling, cabinets, and counters. This means buyers may want a home with an up-to-date kitchen but they aren't willing to tackle this problem themselves. Most buyers want a kitchen that is ready to use the day they move in.

What do buyers look for in up-to-date kitchens? A lot of this depends on what price range your home is in.

The main thing to remember as a seller is to not price yourself out of your market. If homes in your neighborhood are selling for $100,000 with tidy, but not luxury kitchens, then this is no time to upgrade to granite, travertine, and marble at the price tag of $40,000+. You simply won't find a buyer.

Scope out the competition. Use open houses in your area or MLS listings to find out what your competitions' kitchens look like.

Do area homes have new solid wood cabinets and granite counters in today's designer colors? You'll be wise to consider making the same move. Are they including new stainless steel appliances and add-ons like dishwashers, wine-coolers, and trash compactors?

Are you in a higher-end neighborhood? It's time to think high-end. Your older home may have a highly functional kitchen, but a buyer will take one look at your formica counters and white appliances and become lost in the stress of how much money and time it would take to remodel. If you don't want to put in the time yourself to make upgrades then you'll have to make concessions in the price.

Don't become overwhelmed, though. Sometimes a kitchen update can mean doing just a few minor changes. Change the paint color to a warm, neutral tone. Get rid of any clutter. Update your appliances, paint your cabinets, change the pulls, or get a high-end looking counter for a fraction of the cost (faux-granite or lower end granite). You might even save a bundle by doing much of the work yourself.

The bottom line is a kitchen can sell a home. Do a little research and find out what your kitchen needs to make it competitive with area listings.

Is Phoenix On The Top 10 Hot Spots for International Home buyers?

International buyers accounted for 4.2 percent of Phoenix home sales between May 2011 and January 2012, with 90 percent of them from Canada, according to public records analyzed by DataQuick.

Foreign buyers accounted for 3.9 percent of sold homes in Phoenix during that time in Maricopa County and 7.1 percent of homes sold in Pinal County. Maricopa County contains about 90 percent of the Phoenix metro's population of 4.2 million.

Resale condos were proportionally the most popular property type in both counties: buyers listing non-U.S. mailing addresses purchased 9.7 percent of resale condos in Maricopa and 12.2 percent in Pinal, according to DataQuick.

Existing, single-family homes sold for a median $118,800 in the last three months of 2011, down 10.2 percent from the year before. Existing condos sold for a median $66,100, down 4.1 percent.

Foreign investment clients see the current return on investment, combined with investing in the U.S., as superior to other areas and they look forward to future appreciation in the Phoenix area. Our warm climate is also desirable to foreign investors.

The (Canadian dollar to U.S. dollar) conversion rate is good. Homes in Phoenix are still cheap -- although that has changed in recent months.

Most of foreign clients are looking for investments to make monthly returns between 6 (and) 10 percent for the short term, and then sell for a profit when the market price is up in five to 10 years. If they are purchasing a second home, they want to take advantage of the lower prices and favorable conversion rate. They will use the home as a vacation/winter home now, then eventually retire here.

According to statistics from real estate data firm The Information Market, Canadian buyers were virtually non-existent in the Phoenix real estate area from at least 1999 until the fall of 2007. In 2008 they hovered around 2 and 3 percent of the market, but it wasn't until December 2009 that they hit more than 4 percent of the market and have since more or less stayed above that threshold.

Canadian buyers peaked in April 2011, when they accounted for 6.2 percent of the market; they accounted for 4.8 percent of all buyers in February.

<strong>Buying for long-term investment</strong>

From the beginning, Canadian real estate appraiser and U.S. real estate investor Richard McMahon said he knew he wanted to invest in a distressed U.S. market with low prices and the potential for retirement-income generation that would far exceed any yield from a bank savings account.

"Also, having a source of U.S. funds is a good hedge against the Canadian dollar," McMahon said.

An American real estate expert, whose name he said he can't recall, also gave him some valuable advice.

We recommended that he invest in a city that has well-known universities and at least three professional sports teams and has a leisure component to its economy. Presto, Phoenix!

He said he wasn't worried about the legal or tax implications of buying real estate in the U.S. because he'd read "South of 49: The Canadian Guide to Buying Residential Real Estate in the U.S."

He and his partners have so far bought four homes in the Phoenix area, all for long-term investment.

"We do not mind whether it is a short (sale) or a bank property. The first two need some work (while) the last two were near move-in ready. We initially were looking for condos but ultimately chose houses due to their low vacancy and price points (compared to condos)," McMahon said.

Though still high by national standards, in 2010 the Phoenix area had the third-lowest vacancy rate among the 10 markets in this report, at 16.5 percent.

Nearly two out of five sales in the Phoenix area were distressed sales in the fourth quarter -- a rate second only to that in the Las Vegas area among the 10 markets in this report. The Phoenix area also had the second-highest foreclosure activity rate in the fourth quarter, with 1 in 80 units receiving a foreclosure filing.

Foreign buyers accounted for 3.9 percent of sold homes in Phoenix during that time in Maricopa County and 7.1 percent of homes sold in Pinal County. Maricopa County contains about 90 percent of the Phoenix metro's population of 4.2 million.

Resale condos were proportionally the most popular property type in both counties: buyers listing non-U.S. mailing addresses purchased 9.7 percent of resale condos in Maricopa and 12.2 percent in Pinal, according to DataQuick.

Existing, single-family homes sold for a median $118,800 in the last three months of 2011, down 10.2 percent from the year before. Existing condos sold for a median $66,100, down 4.1 percent.

Foreign investment clients see the current return on investment, combined with investing in the U.S., as superior to other areas and they look forward to future appreciation in the Phoenix area. Our warm climate is also desirable to foreign investors.

The (Canadian dollar to U.S. dollar) conversion rate is good. Homes in Phoenix are still cheap -- although that has changed in recent months.

Most of foreign clients are looking for investments to make monthly returns between 6 (and) 10 percent for the short term, and then sell for a profit when the market price is up in five to 10 years. If they are purchasing a second home, they want to take advantage of the lower prices and favorable conversion rate. They will use the home as a vacation/winter home now, then eventually retire here.

According to statistics from real estate data firm The Information Market, Canadian buyers were virtually non-existent in the Phoenix real estate area from at least 1999 until the fall of 2007. In 2008 they hovered around 2 and 3 percent of the market, but it wasn't until December 2009 that they hit more than 4 percent of the market and have since more or less stayed above that threshold.

Canadian buyers peaked in April 2011, when they accounted for 6.2 percent of the market; they accounted for 4.8 percent of all buyers in February.

<strong>Buying for long-term investment</strong>

From the beginning, Canadian real estate appraiser and U.S. real estate investor Richard McMahon said he knew he wanted to invest in a distressed U.S. market with low prices and the potential for retirement-income generation that would far exceed any yield from a bank savings account.

"Also, having a source of U.S. funds is a good hedge against the Canadian dollar," McMahon said.

An American real estate expert, whose name he said he can't recall, also gave him some valuable advice.

We recommended that he invest in a city that has well-known universities and at least three professional sports teams and has a leisure component to its economy. Presto, Phoenix!

He said he wasn't worried about the legal or tax implications of buying real estate in the U.S. because he'd read "South of 49: The Canadian Guide to Buying Residential Real Estate in the U.S."

He and his partners have so far bought four homes in the Phoenix area, all for long-term investment.

"We do not mind whether it is a short (sale) or a bank property. The first two need some work (while) the last two were near move-in ready. We initially were looking for condos but ultimately chose houses due to their low vacancy and price points (compared to condos)," McMahon said.

Though still high by national standards, in 2010 the Phoenix area had the third-lowest vacancy rate among the 10 markets in this report, at 16.5 percent.

Nearly two out of five sales in the Phoenix area were distressed sales in the fourth quarter -- a rate second only to that in the Las Vegas area among the 10 markets in this report. The Phoenix area also had the second-highest foreclosure activity rate in the fourth quarter, with 1 in 80 units receiving a foreclosure filing.

Housing Is ‘Awakening From Hibernation,’ Freddie Says

An improving economy is contributing to a gradual rebound in home prices across the country, according to mortgage giant Freddie Mac’s 2012 Economic Outlook report, released Wednesday. But there is still a way to go in the road to recovery for the housing market, the report noted.

“The housing market is showing some signs of shaking off the depression-like conditions that have plagued it for much of the past few years,” according to the report. “As if awakening from hibernation, housing starts and home sales moved to higher levels of activity.”

In fact, the signs have prompted Freddie Mac to revise its forecast upwards for home sales and originations. One economic contributor that’s helping to stabilize housing: The drop in the unemployment rate to 8.3 percent, its lowest level in three years, according to the report.

“A variety of encouraging indicators suggest that the housing market may be feeling a nascent recovery ... and more neighborhoods may see a stabilization in overall demand and housing values this spring,” says Frank Nothaft, Freddie Mac’s chief economist.

Median home sale prices are up, despite a slight drop in new and existing home sales, Freddie Mac reports. About a half of the increase in housing starts has been for construction of rental apartments in multi-unit buildings to meet the increasing demand, the report notes. New rental construction, at its current pace, is expected to reach its highest level since 2005.

“Housing starts continue to run below net household formations [and will allow for absorption of existing vacant homes],” according to the report.

Homes for sale in Phoenix have experienced an 8.9% increase in the average sales price due to buyers jumping into the market to try to get a good deal. We are seeing multiple offers on homes in Phoenix similar to what Phoenix experienced during the real estate boom. This is good news for the Phoenix real estate market.

“The housing market is showing some signs of shaking off the depression-like conditions that have plagued it for much of the past few years,” according to the report. “As if awakening from hibernation, housing starts and home sales moved to higher levels of activity.”

In fact, the signs have prompted Freddie Mac to revise its forecast upwards for home sales and originations. One economic contributor that’s helping to stabilize housing: The drop in the unemployment rate to 8.3 percent, its lowest level in three years, according to the report.

“A variety of encouraging indicators suggest that the housing market may be feeling a nascent recovery ... and more neighborhoods may see a stabilization in overall demand and housing values this spring,” says Frank Nothaft, Freddie Mac’s chief economist.

Median home sale prices are up, despite a slight drop in new and existing home sales, Freddie Mac reports. About a half of the increase in housing starts has been for construction of rental apartments in multi-unit buildings to meet the increasing demand, the report notes. New rental construction, at its current pace, is expected to reach its highest level since 2005.

“Housing starts continue to run below net household formations [and will allow for absorption of existing vacant homes],” according to the report.

Homes for sale in Phoenix have experienced an 8.9% increase in the average sales price due to buyers jumping into the market to try to get a good deal. We are seeing multiple offers on homes in Phoenix similar to what Phoenix experienced during the real estate boom. This is good news for the Phoenix real estate market.

Thursday, March 29, 2012

8 Metros Where List Prices Are on the Rise

A number of housing markets nationwide have been seeing modest increases in median list prices. In the last year alone, median national list prices ticked up 6.82 percent year over year in February, according to Realtor.com data of 146 metro markets. And a number of markets have seen increases in just one month by 3 or 4 percent.

The following are the eight metro areas that saw the highest median list price increases from January to February:

1. San Jose, Calif.

Month-over-month increase: 4.20 percent

Median list price: $468,888

2. Washington, D.C.-Md.-Va.-W.Va.

Month-over-month increase: 4.17 percent

Median list price: $384,950

3. Detroit

Month-over-month increase: 3.92 percent

Median list price: $84,900

4. Corpus Christi, Texas

Month-over-month increase: 3.89 percent

Median list price: $165,700

5. San Francisco

Month-over-month increase: 3.77 percent

Median list price: $611,700

6. Punta Gorda, Fla.

Month-over-month increase: 3.35 percent

Median list price: $185,000

7. Atlanta

Month-over-month increase: 3.27 percent

Median list price: $154,900

8. Phoenix, AZ

Month-over-month increase: 3.23 percent

Median list price: $146,000

And where have median list prices fallen the most in the last month? Iowa City, Iowa, where median list prices have declined 4.95 percent, and Toledo, Ohio, where list prices dropped 4.31 percent from January to February, according to Realtor.com data.

The following are the eight metro areas that saw the highest median list price increases from January to February:

1. San Jose, Calif.

Month-over-month increase: 4.20 percent

Median list price: $468,888

2. Washington, D.C.-Md.-Va.-W.Va.

Month-over-month increase: 4.17 percent

Median list price: $384,950

3. Detroit

Month-over-month increase: 3.92 percent

Median list price: $84,900

4. Corpus Christi, Texas

Month-over-month increase: 3.89 percent

Median list price: $165,700

5. San Francisco

Month-over-month increase: 3.77 percent

Median list price: $611,700

6. Punta Gorda, Fla.

Month-over-month increase: 3.35 percent

Median list price: $185,000

7. Atlanta

Month-over-month increase: 3.27 percent

Median list price: $154,900

8. Phoenix, AZ

Month-over-month increase: 3.23 percent

Median list price: $146,000

And where have median list prices fallen the most in the last month? Iowa City, Iowa, where median list prices have declined 4.95 percent, and Toledo, Ohio, where list prices dropped 4.31 percent from January to February, according to Realtor.com data.

Short Sales Get Shorter: New Deadlines to go into Effect

As part of a settlement with state attorneys general, the five largest mortgage servicers are adopting new requirements for short sales, which is expected to speed-up what has been known as a lengthy process.

Here are some of the new requirements for servicers under the settlement:

Servicers must provide borrowers with a decision within 30 days after receiving a short sale package request.

"If a real estate broker can get a checklist from the bank detailing what documentation is needed, everything can be provided up front, and the bank will be required to give a thumbs-up or a thumbs-down within 30 days,” short sale specialist Chris Hanson with the Hanson Law Firm told HousingWire. “That's not a bad deal.”

Here are some of the new requirements for servicers under the settlement:

Servicers must provide borrowers with a decision within 30 days after receiving a short sale package request.

- Servicers will be required to notify a borrower, also within 30 days, if any necessary documents are missing to process the short sale request.

- Servicers must notify a borrower immediately if a deficiency payment is needed to approve the short sale. They also must provide an estimated amount for the deficiency payment needed for the short sale.

- Servicers are also required to form an internal group to review all short sale requests. Banks will be considered in violation of the settlement requirements if they take longer than 30 days on more than 10 percent of the short sale requests. Violations can carry fines of up to $1 million and $5 million for repeat offenses.

"If a real estate broker can get a checklist from the bank detailing what documentation is needed, everything can be provided up front, and the bank will be required to give a thumbs-up or a thumbs-down within 30 days,” short sale specialist Chris Hanson with the Hanson Law Firm told HousingWire. “That's not a bad deal.”

Have Home Prices Finally Reached Bottom?

“Prices are bottoming now,” according to a Bank of America Merrill Lynch forecast, released this week.

In the fall, the analysts had predicted home prices would drop by 8 percent from the second quarter of 2011 through the first quarter of 2013 — but now they’re revising that forecast, realizing the housing market is stabilizing faster than they originally thought.

The analysts now predict that prices will remain flat for the next two years, as the excess foreclosure inventory is absorbed. They then expect to see a pickup in home prices by 2014.

And in the long-term, they see a big rise in housing prices. From 2012 through 2020, analysts forecast a cumulative growth of 42 percent in home prices (at 4 percent on an annualized basis).

Phoenix Arizona real estate prices have started to increase due to increase demand from investors and home buyers looking for a good deal. The Phoenix real estate market is currently in a transition phase where buyers are now submitting offers over asking price. The days of the sellers have to lower their prices to sell their homes is now over. Phoenix real estate agents are advising their client to submit offers over asking price so that their buyers can purchase a home at the bottom of the market.

In the fall, the analysts had predicted home prices would drop by 8 percent from the second quarter of 2011 through the first quarter of 2013 — but now they’re revising that forecast, realizing the housing market is stabilizing faster than they originally thought.

The analysts now predict that prices will remain flat for the next two years, as the excess foreclosure inventory is absorbed. They then expect to see a pickup in home prices by 2014.

And in the long-term, they see a big rise in housing prices. From 2012 through 2020, analysts forecast a cumulative growth of 42 percent in home prices (at 4 percent on an annualized basis).

Phoenix Arizona real estate prices have started to increase due to increase demand from investors and home buyers looking for a good deal. The Phoenix real estate market is currently in a transition phase where buyers are now submitting offers over asking price. The days of the sellers have to lower their prices to sell their homes is now over. Phoenix real estate agents are advising their client to submit offers over asking price so that their buyers can purchase a home at the bottom of the market.

New Changes To FHA Lending Guidelines ~ Will You Be Impacted?

This is very important news about the recent changes to FHA loans, the new FHA guidelines. Especially since 95% of new financing is being originated as FHA loans. The changes in mortgage insurance really wont impact borrowers as much. For example, on a $150,000 purchase, the monthly insurance payment will increase by $18.00 a month.

However, the following notice to the FHA loan requirements is going to knock out a lot people from the market. This is FHA’s solution to motivate borrowers to clean up their credit and negotiate payment plans.

Collection Accounts and Judgments:

Open collection accounts and judgments must be addressed in following ways:

If the total outstanding balance of all collection accounts is equal to or greater than $1,000 the borrower must resolve the accounts (e.g. entered into payment arrangements with a minimum of three months verified payments made as agreed in payment plan) or paid in full prior to closing. Documentation must be provided to show that each account was resolved or paid in full. Any payments arranged for the collections must be included in the calculation of the borrower’s debt-to-income ratios.

If the total outstanding balance of all collection accounts is less than $1,000, the borrower is not required to pay off the collection accounts as a condition of mortgage approval.

Note: Paying “down” of balances on collections to reduce the singular or cumulative balance to below $1,000, is not an acceptable resolution of accounts.

Tuesday, March 13, 2012

Phoenix Residential Market Report ~ March 2012

This data includes single family detached homes, patio homes, condos, and townhomes provided by the Arizona Multiple Listing Service. The monthly charts above are based on trailing twelve monthly averages from March 2011 to February 2012 which shows the total activity in the Phoenix Metropolitan real estate market over a twelve month period. The yearly charts above are based on a yearly average for 2005 to 2011 but a trailing twelve month average from March 2011 to February 2012 for the year 2012. Without the trailing twelve month average for the year 2012, the charts would be substantially skewed and would not portray an accurate view of the market on an annual basis.

As you can see from the first chart above, Position Realty Market Index, the first time home buyer tax credit created a great deal of demand in the market similar to the real estate boom from 2004 to 2006. When the government withdrew the first time home buyer tax credit on April 30, 2010, the average sold price and number of transactions decreased and the average days on market increased. Currently, the residential real estate market is experiences another buying frenzy that is caused without government intervention or relaxed mortgage underwriting standards. Consumers are jumping into the real estate market because market statistics are indicating the market has hit bottom and investors can purchase homes at rock bottom prices where they can rent the homes out to receive a 10% to 15% or more return on investment. As found in the Average Sold Price chart above, real estate prices have been increasing steadily since October 2011 due the increase in demand. The current supply of homes for sale on the market is 22,081 where a year ago there were 48,000 homes for sale.

Since March 2011, the average sold price has increased approximately +5.6% (up from last month), the average days on market have decreased approximately -20.4% (down from last month) and the number of transaction has decreased approximately .27.2% (up from last month). It should be noted that approximately +35% of all transaction are cash purchases either by investors or homeowners due to tighter lending requirements. The volume of REO purchases since January is down -63.3% and the volume of short sale is up +7.1%. The volume of REO purchases are shrinking due to the increased volume of trustee sales, more banks are accepting short sale transaction and existing supply of inventory is getting absorbed at a faster rate.

The real estate market has reached a level of equilibrium where demand is exceeds supply and all buyers are rushing into the market to take advantage of low prices. Once the supply of residential homes is exhausted and demand continues to increase, real estate prices will increase at a faster rate (depends on the sustained level of demand). Trying to “time the market” for the perfect time to buy is nearly impossible but there is no better time than now to purchase. Real estate prices are at an all time low, mortgage rates are at a historical low and the market appears to be improving both in terms of prices and the overall economy. Time to buy is NOW!! Give us a call to discuss your best buying strategy, TODAY!!

Thursday, February 9, 2012

More Deals Falling Through Due To Appraisal Issues

Appraisals coming in lower than the agreed-upon sales price continue to cause more real estate deals to be cancelled, recent surveys show.

In December, a third of real estate professionals reported they had a real estate contract fall through, up from 9 percent a year earlier.

The National Association of REALTORS®, along with other housing industry groups, point to low appraisals and rejected mortgage applications from a stringent lending environment as the main forces behind the high number of transaction cancellations in recent months.

Too often, foreclosures sales — which tend to be sold at big discounts — are being weighted into valuations, experts argue.

The National Association of Home Builders’ chairman Bob Nielsen has called the use of distressed and foreclosure sales in comparables in appraisals “inappropriate” and “needlessly driving down home prices.”

Sixty percent of builders say they are seeing problems from appraisals coming in below their contract sales price.

Sixty percent of builders say they are seeing problems from appraisals coming in below their contract sales price.

“This is not only unfair and unreasonable, but it perpetuates the cycle of declining home values, drives more home owners underwater, harms local economic activity and acts as an obstacle to the recovery of the housing market,” Nielsen said in a statement in December about appraisals.

But the lending environment also needs to change for the housing market to recover and for fewer deals to stop falling through, housing experts say.

“If we simply return to the normal credit standards, verifying income and looking at the creditworthiness of an individual to stay in a property long term, we think sales will be 15 percent to 20 percent above where they are,” NAR spokesman Walt Molony told Investor’s Business Daily. “There are more people trying to buy homes than are succeeding today.”

Fannie Starts Accepting Online Offers for Properties

Fannie Mae has announced that it is rolling out a pilot program nationwide that will allow real estate agents to now submit and track their offers online for Fannie Mae-owned properties. Once an offer is submitted, you’ll receive confirmation and be able to track its status through Fannie’s HomePath web site.

Fannie first began piloting the program for online offers in 2010 in San Diego, Orlando, Fla., and Detroit. It now be accepting online offers for properties nationwide.

“Collecting offers online through HomePath.com will provide greater transparency for home buyers and their agents,” Jay Ryan, vice president for REO at Fannie Mae, said in a statement. “Our online platform will make it easier to sell properties to owner-occupants, which is a major factor in helping to stabilize communities across the nation.”

For more information on how the new program works, visit HomePath.com.

Will the Real Estate Market Heat Up This Spring?

The spring season usually brings an increase in buying and selling to the real estate market, and housing experts are mostly optimistic that this spring will be even better than recent years.

Some signs are already there: Housing inventories are declining, housing affordability is at record highs, mortgage rates are at all-time lows, and the job market is improving.

Existing-home sales have been edging up in recent months, and for-sale housing inventories were at nearly 2.4 million units in December, reaching its lowest point since 2005, according to National Association of REALTORS® data.

NAR’s Chief Economist Lawrence Yun says home prices are beginning to stabilize in many markets.

Also, NAR’s Housing Affordability Index is at its highest level since the 1970s, which indicates that for the average family housing is very affordable.

The National Association of Home Builders is also predicting an improvement this spring among the new-home sector. NAHB is predicting that home sales will increase 18 percent this year, that’s after facing their lowest on record in 2011.

However, threats to a housing recovery still loom this spring. Strict mortgage lending is keeping some buyers on the sidelines, and foreclosures continue to put downward pressure on overall home prices in many markets.

"The signals are a little hard to extrapolate, but ultimately by the end of this year we should see the housing market on more solid footing," says Celia Chen, senior housing economist with Moody’s Analytics. "So an improvement but off of very, very weak activity."

Some signs are already there: Housing inventories are declining, housing affordability is at record highs, mortgage rates are at all-time lows, and the job market is improving.

Existing-home sales have been edging up in recent months, and for-sale housing inventories were at nearly 2.4 million units in December, reaching its lowest point since 2005, according to National Association of REALTORS® data.

NAR’s Chief Economist Lawrence Yun says home prices are beginning to stabilize in many markets.

Also, NAR’s Housing Affordability Index is at its highest level since the 1970s, which indicates that for the average family housing is very affordable.

The National Association of Home Builders is also predicting an improvement this spring among the new-home sector. NAHB is predicting that home sales will increase 18 percent this year, that’s after facing their lowest on record in 2011.

However, threats to a housing recovery still loom this spring. Strict mortgage lending is keeping some buyers on the sidelines, and foreclosures continue to put downward pressure on overall home prices in many markets.

"The signals are a little hard to extrapolate, but ultimately by the end of this year we should see the housing market on more solid footing," says Celia Chen, senior housing economist with Moody’s Analytics. "So an improvement but off of very, very weak activity."

Thursday, February 2, 2012

Investors Jump in to Turn Foreclosures into Rentals

The government and private equity firms are gearing up to start marketing foreclosed homes as rentals in an effort to help lessen the downward impact foreclosures have on the price of nearby homes.