Phoenix Real Estate Market Report Summary

This data includes single family detached homes, patio homes, condos, and townhomes provided by the Arizona Multiple Listing Service. The monthly charts above are based on trailing twelve monthly averages from July 2010 to June 2011 which shows the total activity in the Phoenix Metropolitan real estate market over a twelve month period. The yearly charts above are based on a yearly average for 2005 to 2010 but a trailing twelve month average from July 2010 to June 2011 for the year 2011. Without the trailing twelve month average for the year 2011, the charts would be substantially skewed and would not portray an accurate view of the market on an annual basis.

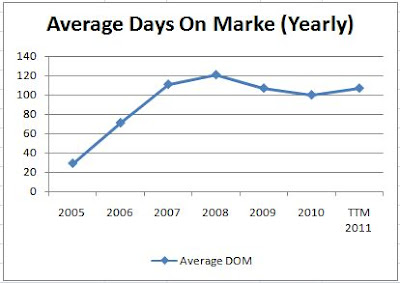

As you can see from the first chart above, Cromford Market Index, the first time home buyer tax credit created a great deal of demand in the market similar to the real estate boom from 2004 to 2006. When the government withdrew the first time home buyer tax credit on April 30, 2010, the average sold price and number of transactions decreased and the average days on market increased. Currently the residential real estate market is experiences another buying frenzy that is caused without government intervention or relaxed mortgage underwriting standards. Consumers are jumping into the real estate market because market statistics are indicating the market has hit the bottom and investors can purchase homes at rock bottom prices where they can rent the homes out to receive a 15% to 20% or more return on investment. Due to the current oversupply of homes on the market, real estate prices have not increased significantly but once the supply of homes are purchased real estate prices will start to increase at a faster pace (Chart #2 shows supply). Since January 2011, the average sold price has increased approximately +1.1% (up from last month), the average days on market have decreased approximately -7.2% (down from last month) and the number of transaction has increased approximately +90.7% (up substantially from last month). It should be noted that the month of June experienced 12,190 transaction of which 5,728 transaction were bank owed (up 85.4% since January) and 3,028 transaction were short sales (up 120.2% since January.

The number of Notice of Trustee Sales is currently experiencing a decline due to the declining number of adjustable rate mortgages coming due and from more lending institutions working harder on helping people stay in their homes. The number of foreclosures “notices” entering the market is expected to continue its decline in late 2011 and early 2012 due to the exhaustion of adjustable rate mortgages created between 2003 to 2007. The number of trustee’s deeds issued at the foreclosure auctions was on a steep incline but it has recently tapered off which means the competition for trustee properties is decreasing. According to the above market statistics, the demand for trustee sale foreclosures is decreasing due to the great deal of competition that was experienced over the last three months but the demand for REO properties is increasing. The real estate market has reached a level of equilibrium where demand is equal to supply and all buyers are rushing into the market to take advantage of low prices. Once the supply of residential homes are exhausted and demand continues to rise, real estate prices will begin to rise (depends on the sustained level of demand). Time to buy!!

No comments:

Post a Comment